Donating Stock is Easy.

How It Works

- You transfer appreciated securities to Reef Environmental Education Foundation (REEF).

- REEF uses the proceeds to fund critical conservation work.

Gifts of Stock Can be Made in Two Ways

- Transfer by broker: Draft a letter to your broker providing instructions for the stock transfer. Your broker should then contact us at giving@REEF.org to confirm details on the transmittal of the gift. Click here for REEF's wire stock transfer form, then mail, fax, or email a completed copy to REEF.

- Mail certificate: Send the stock certificate(s) by certified mail to REEF. In a separate envelope, mail REEF your signed stock power form and a dated letter that identifies the stock, states how your gift is to be used and includes your signature exactly as it appears on the certificate. Send them on the same day by certified mail to:

Reef Environmental Education Foundation

PO Box 370246 (or 98300 Overseas Hwy)

Key Largo, FL 33037-0246

(305) 852-0030

You qualify for benefits based on your total annual giving. Click here to learn about our Donor Recognition Program.

For further information or to talk with someone about the impact your gift will have for protecting the oceans, call 305-852-0030, or email giving@REEF.org.

How You Benefit

- You receive credit and an immediate income tax deduction for the fair market value (average high and low prices on the day of the transfer).

- You avoid capital gains tax.

- Please note that the securities you use to make your gift must have been held by you for more than one year to be fully deductible.

More Information

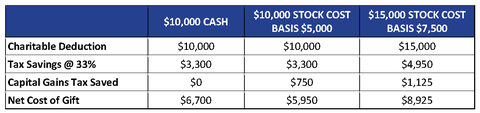

When you donate appreciated securities, you can deduct the gift as a charitable donation AND avoid capital gains tax at transfer, though some capital gains taxation may be a part of the income stream. This double benefit allows you to leverage a larger donation by using appreciated securities rather than cash to make your gift. Here's an example:

Assumptions: Donor in 33% Income Tax bracket; Capital Gains Tax rate 15%

Transferring securities is a simple process, and your financial advisor can help with every step.

For further information or to talk with someone about giving to REEF, please call 305-852-0030 or email giving@REEF.org.

Matched Gifts: Many corporations offer a matching gift program. Click here to find out more.

Other Ways to Celebrate:

Donate to REEFHonor SomeoneGifts of StockPartner with REEFCorporate PartnersShop to SupportSponsor an EventPlanned Giving

REEF’s focus is to develop strong programming to engage and inspire the public through citizen science, education, and partnering with the scientific community to achieve a healthier ocean. This commitment to our mission has been recognized by Great Nonprofits and GuideStar. REEF has an exceptional ‘Give with Confidence’ rating on Charity Navigator, joining the less than 1% of charities with a perfect score for fulfilling our mission in a fiscally-responsible way while adhering to good governance and other best practices. This means your donation goes directly to making a difference for our ocean.